Rates for the Wise

4/23/2024

No Point, No Lender Fee, Refinance Rate: 6.750% / 6.758% APR*

No Point, No Lender Fee, VA IRRRL Rate: 6.240% / 6.290% APR*

No Point, No Lender Fee, FHA Streamline Rate: 6.125% / 6.795% APR*

Contact us for no B.S. mortgage advice.

SELFi by the Numbers

Mortgages Brokered

Mortgage interest saved vs Avg. broker

Mortgage & Real Estate Education Resources

Understanding Prepaid Interest and the Loan Estimate When Refinancing Your Mortgage

When you refinance your mortgage, you may be wondering why there is a charge for something called "prepaid interest." Essentially, prepaid interest is the interest that accrues from the date of...

Congratulations, Your Offer Has Been Accepted! Next Steps for New Home-Buyers

You've found the perfect home and your offer has been accepted by the seller, congratulations! However, the process isn't over yet. There are still several important steps that you'll need to take...

3 Reasons Not to Wait to Refinance after Purchasing

Did you know that you can refinance your mortgage just after buying your home? Most people think you need to wait, anywhere from 6 months to a year, but Fannie Mae and Freddie Mac, the two...

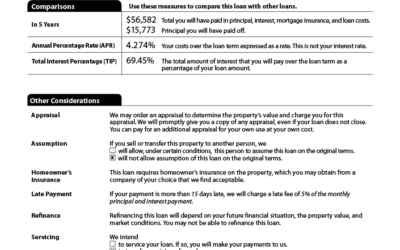

How to Read a Loan Estimate like a Mortgage Pro

In a nutshell: 1) Check if the rate is locked in the top-right hand corner. 2) Check Origination Costs in Section A. 3) Compare against lender credit in Section J. 4) Disregard escrow and prepaid...

A Retiree’s Guide to Mortgage Refinancing

Congratulations, you’ve made it to retirement. Now what? Golf, travel, relax by the beach, refinance your mortgage. Say, what? Conventional wisdom holds that you shouldn’t have a mortgage to pay by...

The Pros & Cons of the New 40 Year Mortgages

You’ve heard of the 15-year mortgage and the 30-year mortgage, but soon, for a select group of borrowers, there’ll be a 40-year mortgage option. Ginnie Mae, the government-owned mortgage bond...

Why are mortgage interest rates so different among companies?

The housing market is hot throughout much of the country right now and interest rates are low, which makes it a prime time to buy a house or refinance your mortgage. But when confronted with the...

Warren Buffett’s Golden Advice on Refinancing your Mortgage

Warren Buffett's views on stocks are well documented but when it comes to real estate, his opinions are not as publicized. In 2011, he shared this piece of golden advice with CBNC's Squawk...

Top 3 Mistakes Homeowners Make when Refinancing

Number 1: You choose the wrong company It's as simple as that. According to the CFPB, 47% of mortgage applicants fail to shop around for their mortgage. Most often, homeowners will refinance...

Do you know about wholesale interest rates?

I always tell people, the biggest competition for SELFi is consumer misunderstanding. The more knowledgeable a customer is about mortgage rates, the more likely SELFi will earn his or her...