Here’s how SELFi compares to Better Mortgage:

1. Interest Rates

Let’s cut right to the chase.

First, how the business models differ:

SELFi is a marketplace that shops wholesale interest rates across 15 lending partners, using an algorithm to match the lowest rate partner.

Better is a correspondent lender that closes the loan in it’s own name, then sells the loan after closing.

Using a sample scenario at today’s rates (5/9/19), assume $800,000 purchase price, $600,000 loan amount, 760 credit score. Here are the rates on a 30 year fixed:

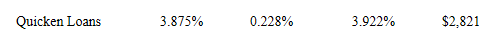

- SELFi to Quicken Loans = 3.875% / 3.922% APR with $2,303 in lender points and fees.

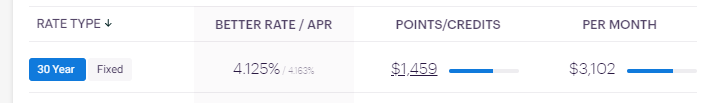

- Better Mortgage = 4.125% / 4.163% APR, with $1,459 in lender points and fees.

The difference in payment is $281 a month, which adds up to $101,160 over the life of the loan, much more if you factor in compound interest.

Note, this interest rate with Quicken Loans is only available through SELFi, you cannot get the same low rate working directly with Quicken Loans / Rocket Mortgage.

2. Loan Programs

Better offers conventional, jumbo, and FHA loans to borrowers with a 620 credit score and above.

SELFi offers those same programs, plus hundreds more: HELOCs, VA loans, loans with imperfect credit, 2nd mortgages, portfolio loans, loans on manufactured homes, etc.

3. Servicing the loan after closing

Neither company services the loan after closing.

With SELFi, the lending partner will service the loan but always retains the rate to transfer servicing in the future.

Better Mortgage transfers ownership of your loan to the investor after loan the closes. You will not know which lender services your loan.

4. State Licensing

Better Mortgage is licensed in 35 states.

SELFi is licensed in 3 states.

5. Experience of advisers

SELFi Mortgage Coaches have an average of 8 years mortgage experience and are reviewed after each transaction to hold accountability.

Better Mortgage requires has no experience requirements to become a loan consultant.

We want your feedback. Leave your comment below.

Mortgage shopping, as it should be

Subscribe to our mailing list

Stay up-to-date on interest rates, loan options, and money saving tips.

Need to borrow on a second rental investment property