Mortgage Education Blog

Lifting the curtain on mortgage lendingWhy are mortgage interest rates so different among companies?

The housing market is hot throughout much of the country right now and interest rates are low, which makes it a prime time to buy a house or refinance your mortgage. But when confronted with the myriad choices—whether you are a seasoned homeowner or a new buyer—the...

Warren Buffett’s Golden Advice on Refinancing your Mortgage

Warren Buffett's views on stocks are well documented but when it comes to real estate, his opinions are not as publicized. In 2011, he shared this piece of golden advice with CBNC's Squawk Box: "If you take out a 30 year fixed mortgage and it turns out the...

Top 3 Mistakes Homeowners Make when Refinancing

Number 1: You choose the wrong company It's as simple as that. According to the CFPB, 47% of mortgage applicants fail to shop around for their mortgage. Most often, homeowners will refinance with their existing lender, thinking that lender will offer the best...

Ready to find your lowest rate?

SELFi empowers you to save the most money on your new home purchase or mortgage refinance.

DIY Refi

- Low wholesale mortgage rates

- Quick and secure online application

- SELFi Mortgage Coach to guide you

Second Look

- Solutions for tough to qualify

- Independent mortgage advice

- Loans down to 500 credit score

Low Down Payment

- 5% down Conforming

- Independent mortgage advice

- Underwritten pre-approval

3 Companies that Failed to Disrupt Real Estate

Disclaimer: The perspective and opinions of this article are based on the author's perception. Consult with your financial adviser for any investing questions. Compass, Inc. (COMP) | Amount Raised: $1.5B| Market Valuation: $1.049B Real Estate Segment:...

Today’s Refinance Rates in Viriginia – July 2022

SELFi DIY Refi® is live in Virigina. How do you DIY Refi® and save? 1) Check today's refinance rates 2) Compare against other lenders so you know the rate through SELFi is the lowest. Learn how to read a Loan Estimate like a Mortgage Pro. 3) Apply online Step 1:...

Digital Mortgage Broker Comparison Chart: SELFi vs. OwnUp vs. Simplist vs. Morty

Shopping for a mortgage can be overwhelming. Since the advent of the internet, lead generation companies have been capitalizing on that financial insecurity by collecting your information through online funnels and then selling your information on all over the...

3.5% Down Payment on Jumbo Loans to $1.5M now available in Phoenix Arizona

Often the biggest barrier for first-time home-buyers in first-time home-buyers in Arizona is the down payment. Traditional banks typically require 20% down. In Scottsdale, AZ, the median home value is a whopping $900K in April 2022, up 20% year-over-year. For a...

3.5% Down Payment on Jumbo Loans to $1.5M now available in Seattle area

Often the biggest barrier for first-time home-buyers in first-time home-buyers in Washington is the down payment. Traditional banks typically require 20% down. In Seattle, the median home value is a whopping $829K million, where a 20% down payment equates to $165,800....

3.5% Down on Jumbo Loans to $1.5M comes to the San Francisco Bay Area in 2022

Often the biggest barrier for first-time home-buyers in San Francisco is the down payment. Traditional banks usually require 20% down. In San Francisco, the median home value is a whopping $1.14 million, where a 20% down payment equates to $228,000. 3.5% Down,...

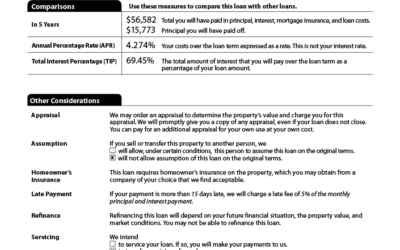

How to Read a Loan Estimate like a Mortgage Pro

In a nutshell: 1) Check if the rate is locked in the top-right hand corner. 2) Check Origination Costs in Section A. 3) Compare against lender credit in Section J. 4) Disregard escrow and prepaid taxes and insurance - that will be the same regardless of lender. 5)...

Hippo Insurance: A SELFi Breakdown (June 2022 Review)

End result of findings and study: Hippo homeowners insurance is 17% lower than its competitors for comparable policy. Hippo back-story Hippo was founded by Assaf Wand a former McKinsey consultant and Eyal Navon, an entrepreneur with an extensive background in software...

Talking Salary Cap: An inside look at cap space for the 2022-23 NBA Season

As fans and the unofficial sponsor of our NBA neighbors, the Golden State Warriors, SELFi employees have had a good run watching some of the best basketball played on the planet. A big part of what keeps the well-oiled Warrior machine running is their ownership’s...

Down Payment Assistance Program Now Offered through SELFi

Often the biggest barrier to being a first-time home-buyer is the down payment. FHA requires 3.5% down. Conventional often requires 5% down. For California homes, that could mean tens of thousands of dollars. What if you don't have the 3.5% down but want to...

Refinancing and Divorce: What You Need to Know

A theme that has come up with borrowers quite often in my experience are the mortgage unknowns following divorce. The primary question potential borrowers have when contemplating a refinance following a divorce is – Do I qualify? Without being sure whether a new...

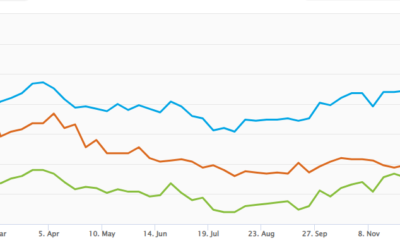

March 22nd Interest Rate Update: Mortgage Rates Hit 3 Year High

Goodbye interest rates in the 2s. Hello interest rates in the 4s. Mortgage interest rates hit their highest level in 3 years in lockstep with the 10 year yield rising to it's highest level in 3 years. What's causing interest rates to jump? Inflation Fastest way...

3 Home Loan Options for Bad Credit

You call your bank or a large lender on TV and they tell you, "Sorry, your credit score is too low. We require a 600 credit score". And if you're like millions of potential home-owners, you give up your search to buy a home right there. Years go by while you continue...

3 Simple Steps to Shop Homeowners Insurance

The key to avoid over-paying on your homeowners insurance is to shop around once a year, usually 60 to 90 days before your renewal. Insurance companies will often attractively price their initial policy quote with the intention to raise prices year-over-year. Here's...

January 21st, 2022: Market Update

For today, January 21st, 2022, the current average mortgage rate on the 30-year fixed-rate mortgage is 3.56%, the average rate for the 15-year fixed-rate mortgage is 2.79% according to FreddieMac. Compare those rates to the historic low rates we saw in late...

Rocket Pro TPO Makes Big Announcements Regarding Future

Rocket Pro TPO Executive Vice President, Austin Niemiec, made a slew of big announcements regarding what’s to come for Rocket Mortgage’s wholesale channel on Tuesday. Over the last 12 months Rocket Pro TPO has partnered with over 3,000 new mortgage brokers and have...

Rocket Pro TPO Raise Conforming Loan Limits

With home prices rising across the country, the Federal Housing Finance Agency is expected to raise their conforming loan limits next month. Rocket Pro TPO, the wholesale channel of Rocket Mortgage that works with mortgage brokers, anticipates $625,000 as the new 2022...

Negative Closing Costs? How to get paid to refinance.

You know the old saying... "what sounds too good to be true, usually is." This especially rings true when it comes to financial services. So the idea that a lender will pay you to refinance your mortgage to a lower interest rate definitely falls into that category....

Renters Rejoice: Your Rent Payments Will Now Help You Own!

People want to buy homes. Demand is on the rise. Homes available for purchase are in short supply and they are more expensive than ever before. You would think becoming a first-time homebuyer is tough enough already. For those of you who have been wary of opening...

A Retiree’s Guide to Mortgage Refinancing

Congratulations, you’ve made it to retirement. Now what? Golf, travel, relax by the beach, refinance your mortgage. Say, what? Conventional wisdom holds that you shouldn’t have a mortgage to pay by the time you are retired. After all, a life free of mortgage payments...

The Pros & Cons of the New 40 Year Mortgages

You’ve heard of the 15-year mortgage and the 30-year mortgage, but soon, for a select group of borrowers, there’ll be a 40-year mortgage option. Ginnie Mae, the government-owned mortgage bond corporation, recently announced a new, longer mortgage term, available to...

Subscribe to our mailing list

Stay up-to-date on interest rates, loan options, and money saving tips.