Mortgage Education Blog

Lifting the curtain on mortgage lendingHow to Read a Loan Estimate like a Mortgage Pro

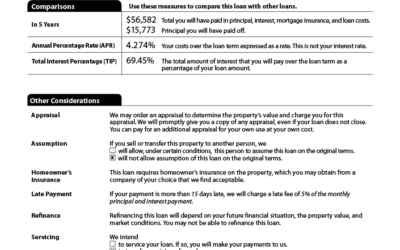

In a nutshell: 1) Check if the rate is locked in the top-right hand corner. 2) Check Origination Costs in Section A. 3) Compare against lender credit in Section J. 4) Disregard escrow and prepaid taxes and insurance - that will be the same regardless of lender. 5)...

A Retiree’s Guide to Mortgage Refinancing

Congratulations, you’ve made it to retirement. Now what? Golf, travel, relax by the beach, refinance your mortgage. Say, what? Conventional wisdom holds that you shouldn’t have a mortgage to pay by the time you are retired. After all, a life free of mortgage payments...

The Pros & Cons of the New 40 Year Mortgages

You’ve heard of the 15-year mortgage and the 30-year mortgage, but soon, for a select group of borrowers, there’ll be a 40-year mortgage option. Ginnie Mae, the government-owned mortgage bond corporation, recently announced a new, longer mortgage term, available to...

Ready to find your lowest rate?

SELFi empowers you to save the most money on your new home purchase or mortgage refinance.

DIY Refi

- Low wholesale mortgage rates

- Quick and secure online application

- SELFi Mortgage Coach to guide you

Second Look

- Solutions for tough to qualify

- Independent mortgage advice

- Loans down to 500 credit score

Low Down Payment

- 5% down Conforming

- Independent mortgage advice

- Underwritten pre-approval

Exploring the Real Estate Empire of LeBron James

LeBron James is not only known for his incredible talent on the basketball court, but also for his savvy business ventures, including real estate. The NBA superstar has built a significant real estate portfolio over the years, and it's worth taking a closer look at...

Why Did My Mortgage Payment Go Up Even Though It’s Fixed Rate?

When you have a fixed rate mortgage, you expect your mortgage payments to remain the same for the life of the loan. But what happens when your mortgage payment suddenly goes up? This can be a frustrating and confusing experience, especially if you're not sure what...

Supplemental Property Taxes: What You Need to Know

When you own a property, it's important to understand all of the taxes that come along with it. One of those taxes is supplemental property tax, also known as a "supplemental assessment." This is a tax that can be imposed on property owners in addition to their...

A Beginner’s Guide to Buying Your First Home

Buying a home can be an exciting and overwhelming experience, especially if it's your first time. There are so many things to consider, from location and budget to mortgage rates and closing costs. But don't let the process intimidate you - with the right guidance and...

Congratulations, Your Offer Has Been Accepted! Next Steps for New Home-Buyers

You've found the perfect home and your offer has been accepted by the seller, congratulations! However, the process isn't over yet. There are still several important steps that you'll need to take before you can move into your new home. In this article, we'll discuss...

The Importance of a Home Inspection During the Home-Buying Process: Tips and Tricks

Here are some tips to keep in mind when it comes to a home inspection: 1. Don't skip the inspection: It's easy to get caught up in the excitement of finding the perfect property, but don't forget the importance of a home inspection. It's a crucial step in the...

The History of Racial Inequality in Homeownership in America

Racial inequality in homeownership has been a persistent issue in America throughout history. The legacy of discrimination and unequal access to homeownership opportunities for minorities, particularly for African Americans, has had a significant impact on the wealth...

8 Tips for New Homeowners: Making a Smooth Transition into Your New Home

Congratulations on becoming a new homeowner! Moving into a new home can be both exciting and overwhelming, but with a little bit of planning and organization, the transition can be smooth and stress-free. Here are some tips to help make your move as seamless as...

Budget Bites: San Francisco’s Best Value Restaurants

San Francisco, known for its steep hills and even steeper prices, can be a tough place to find a good meal at a reasonable price. But fear not, dear foodies, for there are still gems hidden among the overpriced avocado toast and artisanal kale salads. Here are ten of...

Comparing Personal Loan Options with Bad Credit

If you have bad credit, you may find it challenging to get approved for a loan. However, there are still options available to you. In this article, we'll compare some of the most popular personal loan options for consumers with bad credit. 1. Payday loans: Payday...

The Evolution and Challenges of Mortgages in United States: A Historical Perspective

The history of mortgages in the United States can be traced back to the colonial era, when land ownership was a key aspect of American society. In the early days, land was obtained through grants from European governments or by purchase from Native American tribes....

5 Proven Ways to Improve Your Credit Score Fast

Article written by ChatGPT, a chatbot launched by OpenAI. Improving your credit score can take time, but there are steps you can take to improve your credit score quickly. Here are a few ways to boost your credit score in a short amount of time: 1. Pay down your...

Key Terms to Understand When Applying for a Mortgage: A Guide for Borrowers – by ChatGPT

Article written by ChatGPT, a chatbot launched by OpenAI. When applying for a mortgage, it's important to understand several key terms in order to make an informed decision and ensure you're getting the best deal possible. Here are a few important terms that...

When should you refinance your mortgage? By ChatGPT

Article written by ChatGPT, a chatbot launched by OpenAI. As a homeowner, you may have considered refinancing your mortgage at some point. But how do you know if now is the right time to take the plunge? While there are many factors to consider, there are a few key...

Comparing Homeowners Insurance in 2023: 5 Things to Consider – by ChatGPT

Article written by ChatGPT. Chat GPT is a chatbot launched by OpenAI. As a new homebuyer, one important task on your to-do list is selecting a homeowners insurance policy. Homeowners insurance provides financial protection in case of damage to your home or personal...

5 Tips for First-Time Home-Buyers in 2023

As a first-time homebuyer, the process of buying a home can seem intimidating and overwhelming. There are so many things to consider, from finding the right property to getting a mortgage and securing financing. However, with a little preparation and knowledge, the...

Current State of Residential Real Estate – as written by ChatGPT

Article written by ChatGPT. Chat GPT is a chatbot launched by OpenAI in November 2022 and is the tech industry's latest step in language model generative artificial intelligence. Recovering from the Covid-19 Pandemic The residential real estate market in the United...

Mortgage Conversation with ChatGPT

ChatGPT is a chatbot launched by OpenAI in November 2022 and is the tech industry's latest step in language model generative artificial intelligence. The AI bot has been trending on Twitter and amassed over a million users within five days of its launch. We wanted to...

Why SELFi is being called the “Costco of Mortgage”

Ah, Costco. You walk-in wanting to buy some eggs and you leave with a $450 receipt. It's easy to understand Costco's business model - quality goods sold at a lower price. And to achieve that, you shop at warehouses. Almost being flattened by a fork lift is part of the...

Conforming loan limits to increase again in 2023

For the seventh consecutive year, the Federal Housing Finance Agency (FHFA) increased loan limits for Fannie Mae and Freddie Mac backed mortgages. The conforming loan limit will jump from $647,200 to $726,200. For high cost areas, like the Bay Area, the loan limit...

3 Reasons Not to Wait to Refinance after Purchasing

Did you know that you can refinance your mortgage just after buying your home? Most people think you need to wait, anywhere from 6 months to a year, but Fannie Mae and Freddie Mac, the two government sponsored enterprises have no waiting period. So if you just bought...

Subscribe to our mailing list

Stay up-to-date on interest rates, loan options, and money saving tips.